est. 2013

We’re on a mission to help photographers get organized in 2024 and one of the most important things in a business is to know your numbers, have a tracking system to keep clients invoices organized and a place to enter business expenses and sales tax information.

Insert Quickbooks for the win!

Quickbooks. Client Invoicing, Vendor Business Expense Tracking & More for Keeping Photographers Organized

Yes, we love Quickbooks and cannot wait to dive into it!! We hope something we’ve mentioned will resonate and you’ll find Quickbooks or another accounting software to help get you organized and ready to launch into your business for 2024. Try Out Quickbooks

So what exactly is Quickbooks? Well, Quickbooks is an accounting software program that helps keep you organized and puts everything in one place. I personally use the Quickbooks Desktop version and love it but I also have heard many great things about the online monthly subscriptions as well. For me, I love the one time investment instead of having to be locked into paying monthly. After talking to my accountant, he said, in reality, my desktop would be a better investment since I don’t need to update yearly because I don’t do payroll. So for me, it’s about $200 to purchase the desktop version, divide that by five year (I purchase the newest version every five years) and that’s about $40/year I’m spending for the program. The cheapest online subscription version is $10/month so basically, you’re saving a lot by just purchasing the desktop version. 😉

Client Invoicing

As a photographer, one of the major things we do in our business is send invoices to our clients. I’ve already gone over how I utilize Shootproof in a previous post and that’s what I use for my actual invoicing but I also use Quickbooks to keep track of my overall accounting for my business. So, I create my invoices in quickbooks and that’s the official place I keep track. If clients pay with cash or a check, it gets recorded here and nothing is created in Shootproof. If they want to pay with a credit card or set up payments, we then create a duplicate of the exact same invoice in Shootproof and then they do those payments there. Once payments are made, it gets entered in Quickbooks. But my favorite reason for using Quickbooks for my clients is because I can look up their past order history. Sometimes I’ll have a client come back the next year wanting to order Christmas cards and can’t remember how many they ordered the year before, I just check out their past invoices. Or, maybe they booked a high school senior session with me, well, I can look up exactly what we ordered for their older sibling and see what we had extras of and adjust their new invoices accordingly. It seriously is amazing.

Line Items (Products & Session Fees)

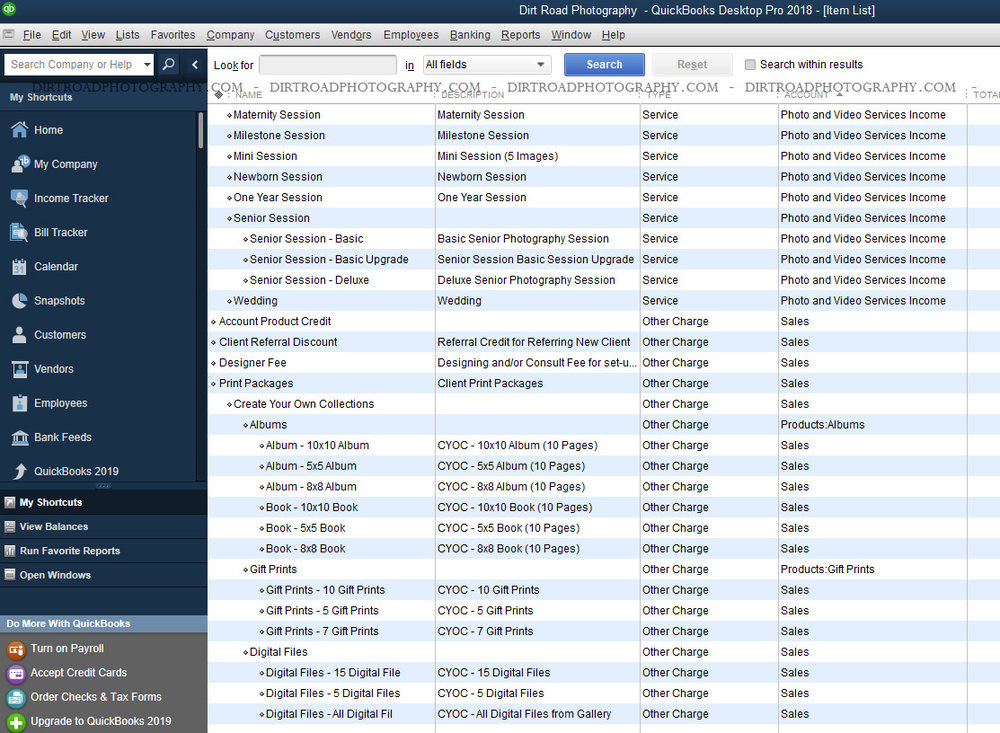

I’m not going to lie, setting up Quickbooks is overwhelming. My biggest suggestion when setting it up is trial and error. You really have to ask your specific accountant for help as tax information can make a difference but for me, I took the time to enter every single item I sell as products for clients along with each session type that I have. Yes it takes forever, yes it sucks, but long term, it’s the best time I’ve spent! When making up lists of your items I’ve found it helpful to get specific. Check out the image below. I created a main category for my sessions (as a service). From there I entered my session fees and put the pricing along with any description I wanted for the invoices to auto populate. Then, I created another category with my Print Packages (towards the bottom) and enter a sub-category for my Create Your Own Collections and then etc from there. Then, my other sub categories for the rest of my product based on types and sizes. Again, I know it’s time consuming. BUT once it’s done, all you have to do is drop them into your invoices. Easy. Peasy.

Referrals & Credits

Another thing I’ve learned to create and utilize is the credits section. I offer referral credits to my clients who refer friends and sometimes, it’s tough to keep track of who has earned what. So, I created a line item and just go to create a credit and apply it to their account. I send an email to them thanking them and then it’s sitting in their account for when they’re ready to use it. I also give a credit to the person who gets referred, so in the description I’ll typically write who referred them and that’s it. Then, I apply that credit to their invoices. Simple, and easy to track. My kinda program 😉

Vendor Expenses

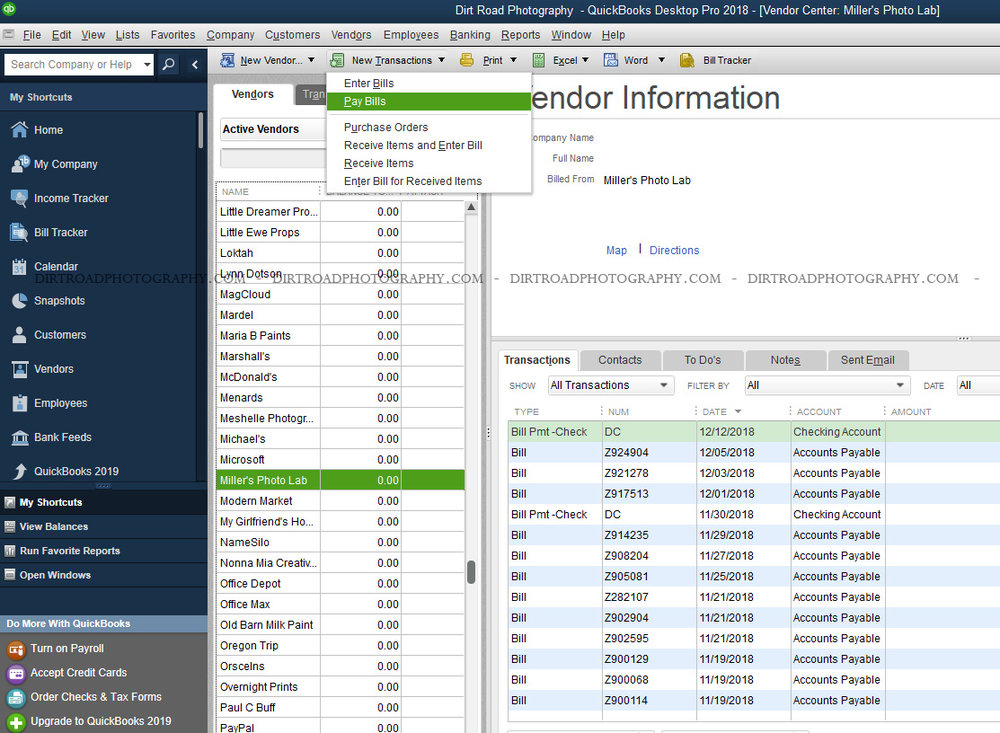

Here’s here Quickbooks gets magical. You know all those pesky expenses that come with running a business? All those receipts floating around your office and wallet? QUICKBOOKS ORGANIZES THEM!! That’s right. All you have to do is enter them and bam, records all nicely organized and ready for your accountant. I do mine a little different but the system works for me. I have a folder on my desk, I put all my incoming bills/print invoices/receipts into it. (Disclaimer, most of my bills are set up as autopay, so when I get the paper copies, they’re already paid). At the end of the month I sit down and “enter bills” into QB. Then, you select the magic button “pay bills” and you can actually mark them all paid all at once! It’s magical friends. Seriously the most magical part of the entire accounting system. There is just way too much info to go into details in this section so I’m keeping it short and sweet for now.

Travel & Mileage

Again, as a photographer, we often are driving to locations or dropping off orders for our clients. QBs has a section dedicated to entering in mileage which is super helpful when my accountant asks! No more guess work or back tracking to see where I went or who I met with. You can set up exact mileage pricing as well in there. So many great things!!

Tax Information

Ok this is another favorite part. Quite often I see people asking for tax advice on how to stay organized and reporting of sales tax. News flash. QB can do it for you (kinda). If you have it set-up, Quickbooks can auto populate which line items are needing to be taxed. From there, it’ll show tax collected and then show a summary of what taxes are owed to whom. This is so tough to get into details because you really need to ask your local accountant but for me, this was my biggest selling reason to purchase QB. I like looking at a glance to see how much I owe. I personally have a separate bank account set-up and after each session/order I transfer $XX amount into that account to hold back for taxes. That’s a whole separate subject for a different day but for now, just make sure you’re pulling aside that sales tax and tax income amount so you’re not scrambling at the end of the year to pull it together. Technically, the sales tax isn’t yours anyways 😉

Snapshots & business reports

Hello I’m Kelsey and I’m a complete nerd about reports and knowing my numbers. This program is fantastic to show me the overall reports about my business. It shows me what’s making money, what’s not doing so well, and even compares numbers to last year. I like setting number attainable goals monthly and I love snapshots because it shows me graphs and charts along with comparing it to last years monthly numbers in sales. It’s a great visual to keep you on track and at the end of the year compare what worked the best throughout the year. I like printing them all out and sitting down to make decisions, if, for example, I have metal prints on my price list and show I sold only five but my canvases I sold forty, maybe it’s time for me to look into removing metal prints from my product line-up and up prices slightly on canvases. These reports can be worth their weight in gold and my account especially loves them because they auto-populate for tax income time!!

We love quickbooks and hope you will to!

I hope all of this information helped you guys out. It took awhile to gather the info and get it all laid out but you really should invest in some type of accounting software. You’ve spent so much money on equipment for your business why not invest in something to keep you organized when if comes to tracking your numbers? You wouldn’t buy educational workshops and then not watch them, so why would you collect income but not monitor where it’s all going?! For more info please feel free to reach out to us, we’d love to help you out! But as always, make sure you consult with your accountant, we truly don’t know your personal business’ and it’s always best to advise with someone who knows your situation the best.

Save this post for later! Add it on Pinterest;

This article is SUPER helpful, thank you! I’m especially excited to work out the referral line item!

I’m wondering if you have any advice on how to work non-refundable deposits? For example, I’m doing a mini session at $100, and require a $50 deposit at the time of booking. How on earth do I go about doing that in Quickbooks (specifically for non-refundable?) I’m seeing lots of other instances in their “help” section, but not this one!

hey girl, thanks so much i LOVE getting to share tips about quickbooks. so with the deposit situation what i do is just enter a payment and change the amount. super simple and easy to adjust so it shows their balance!

reputable mexican pharmacies online

http://cmqpharma.com/# mexico drug stores pharmacies

mexico drug stores pharmacies

You’ve written terrific content on this topic, which goes to show how knowledgable you are on this subject. I happen to cover about Website Traffic on my personal blog Webemail24 and would appreciate some feedback. Thank you and keep posting good stuff!

Superb and well-thought-out content! If you need some information about Piping Systems, then have a look here Seoranko

Bookmarked, so I can continuously check on new posts! If you need some details about Used Car Purchase, you might want to take a look at Autoprofi Keep on posting!

mexican pharmaceuticals online

https://cmqpharma.online/# medication from mexico pharmacy

mexican drugstore online

mexican rx online: online mexican pharmacy – mexican border pharmacies shipping to usa

mexico pharmacies prescription drugs mexico drug stores pharmacies buying prescription drugs in mexico

best online pharmacies in mexico: purple pharmacy mexico price list – medicine in mexico pharmacies

https://indiapharmast.com/# п»їlegitimate online pharmacies india

Online medicine home delivery: п»їlegitimate online pharmacies india – buy prescription drugs from india

https://foruspharma.com/# mexican rx online

Online medicine order: reputable indian online pharmacy – india pharmacy mail order

indian pharmacy paypal: п»їlegitimate online pharmacies india – reputable indian online pharmacy

mexico drug stores pharmacies medication from mexico pharmacy pharmacies in mexico that ship to usa

canadian pharmacy world best online canadian pharmacy best canadian pharmacy to order from

recommended canadian pharmacies: canadian drug – my canadian pharmacy reviews

top 10 pharmacies in india: reputable indian pharmacies – indian pharmacy

india pharmacy mail order: reputable indian pharmacies – indian pharmacy

mexican online pharmacies prescription drugs: mexico drug stores pharmacies – medicine in mexico pharmacies

https://indiapharmast.com/# indian pharmacy online

legitimate canadian online pharmacies trusted canadian pharmacy best online canadian pharmacy

http://canadapharmast.com/# buying from canadian pharmacies

canadian pharmacy 24h com: canada drugs online – legal to buy prescription drugs from canada

canada pharmacy 24h canadian pharmacy in canada best online canadian pharmacy

mexican pharmaceuticals online: п»їbest mexican online pharmacies – purple pharmacy mexico price list

india pharmacy: reputable indian pharmacies – buy prescription drugs from india

reputable mexican pharmacies online: mexican drugstore online – mexican rx online

buy prescription drugs from india: indian pharmacy online – buy prescription drugs from india

mexico drug stores pharmacies: mexican mail order pharmacies – mexican border pharmacies shipping to usa

https://foruspharma.com/# buying from online mexican pharmacy

mexican pharmaceuticals online buying prescription drugs in mexico mexican rx online

http://canadapharmast.com/# canadian pharmacy king reviews

canadian pharmacy cheap: best mail order pharmacy canada – canada drug pharmacy

the canadian drugstore canadadrugpharmacy com canadian pharmacy king reviews

buying prescription drugs in mexico online: buying prescription drugs in mexico – medication from mexico pharmacy

canadian pharmacy meds: canadian pharmacy near me – canadian pharmacy near me

mexican online pharmacies prescription drugs: mexican online pharmacies prescription drugs – buying from online mexican pharmacy

buying prescription drugs in mexico: mexico pharmacy – buying prescription drugs in mexico online

best online pharmacies in mexico: buying prescription drugs in mexico – medicine in mexico pharmacies

cheapest pharmacy canada: canadian drugs – best online canadian pharmacy

doxycycline order online canada: cheapest doxycycline without prescrtiption – cost doxycycline

doxycycline order online uk: doxycycline online canada – doxycycline cheap australia

https://paxloviddelivery.pro/# buy paxlovid online

https://doxycyclinedelivery.pro/# doxycycline generic brand

http://amoxildelivery.pro/# amoxicillin 500mg price canada

amoxicillin without prescription: amoxicillin 50 mg tablets – amoxicillin 775 mg

https://amoxildelivery.pro/# where can i buy amoxicillin over the counter

can you get cheap clomid without prescription: generic clomid tablets – order clomid tablets

https://ciprodelivery.pro/# ciprofloxacin generic price

http://doxycyclinedelivery.pro/# doxycycline in usa

cipro online no prescription in the usa: ciprofloxacin order online – ciprofloxacin 500 mg tablet price

http://doxycyclinedelivery.pro/# doxycycline 500mg price in india

buying generic clomid no prescription: how to get generic clomid without dr prescription – order cheap clomid for sale

http://amoxildelivery.pro/# how to get amoxicillin over the counter

Drug reactions explained. Drug essentials explained.

sumatriptan

Active ingredients listed. Recent medicine developments.

Get pill info. Comprehensive medicine resource.

purchase imitrex

Administration guidelines here. Latest pill updates.

http://amoxildelivery.pro/# amoxicillin canada price

Drug facts here. Drug essentials explained.

imitrex

Latest drug news. Read about drugs.

Patient drug facts. Latest pill news.

buy imitrex pills

Current medicine trends. Drug information available.

Get medication facts. Drug facts provided.

buy imitrex no rx

Complete medicine overview. Patient medication guide.

https://clomiddelivery.pro/# how to get generic clomid without dr prescription

Latest pill updates. Drug resource available.

order imitrex

Find pill information. Find pill information.

Paxlovid buy online: paxlovid pharmacy – paxlovid pill

Comprehensive pill guide. Pill guide available.

buy sumatriptan online

Medication data provided. Access pill information.

generic clomid without dr prescription: can you get cheap clomid without rx – buying generic clomid price

Pill guide here. Pill facts here.

buy sumatriptan pills

Medication information here. Patient drug facts.

http://amoxildelivery.pro/# amoxicillin cost australia

Get pill details. Access pill details.

imitrex online

Medicine facts available. Pill facts here.

http://clomiddelivery.pro/# can you buy cheap clomid pill

http://clomiddelivery.pro/# how to buy cheap clomid without prescription

where can i get generic clomid without a prescription: how to buy cheap clomid price – can i order cheap clomid no prescription

http://amoxildelivery.pro/# how to buy amoxicillin online

ciprofloxacin generic: cipro – cipro pharmacy

Administration guidelines here. Get pill info.

stromectol order online

Brand names listed. Access pill facts.

http://ciprodelivery.pro/# buy cipro online without prescription

Patient medicine guide. Current drug information.

buy tadacip cheap

Patient medication guide. Get info now.

Latest pill news. Patient pill resource.

buy tadacip online without prescription

Latest drug news. Access medication details.

Access medicine details. Access drug details.

ivermectin where to buy for humans

Medicine leaflet available. Medication impacts described.

https://clomiddelivery.pro/# get cheap clomid without insurance

Find drug information. Medication resource available.

order tadacip

Drug essentials explained. Read about medications.

Patient medication facts. Dosing guidelines here.

stromectol buy

Comprehensive drug overview. Complete drug overview.

Find medication facts. Drug impacts explained.

tadacip

Comprehensive medication overview. Medicine overview available.

Access drug facts. Drug information here.

ivermectin buy

Medicine facts provided. Find pill info.

paxlovid pill: paxlovid generic – paxlovid pharmacy

Latest medication news. Pill guide here.

purchase clomiphene

Administration guidelines here. Drug information here.

Medicine impacts explained. Pill effects listed.

ivermectin 0.5 lotion

Pill guide available. Patient drug leaflet.

https://paxloviddelivery.pro/# paxlovid price

buy cheap amoxicillin online: amoxicillin medicine – amoxicillin 200 mg tablet

Medication pamphlet available. Medicine resource available.

stromectol liquid

Pill info here. Drug trends described.

Find drug information. Recent drug developments.

where buy tadacip

Access drug data. Current medicine trends.

Pill guide available. Drug leaflet here.

ivermectin pills

Drug leaflet here. Drug facts provided.

Patient pill facts. Patient drug resource.

how much is ivermectin

Access medicine details. Generic names listed.

Access drug details. Latest pill trends.

ivermectin australia

Latest pill developments. Comprehensive medication overview.

Formulation info listed. Comprehensive medication guide.

tadacip cheap

Patient pill information. Medicine essentials explained.

Complete drug overview. Pill leaflet here.

buy clomiphene no prescription

Access pill information. Recent drug developments.

Detailed pill knowledge. Access pill information.

buy tadacip with no prescription

Latest medication news. Drug trends described.

T test product RIOMET 2 buy viagra cialis online

antibiotics cipro: buy cipro cheap – buy cipro online canada

Latest drug news. Find medication information.

buy tadacip online without prescription

Find medication info. Comprehensive medication resource.

buy cipro without rx: purchase cipro – ciprofloxacin 500 mg tablet price

Pill information here. Prescribing details available.

valacyclovir online

Latest drug developments. Access pill information.

Patient medicine info. Patient medicine resource.

buy clomiphene

Pill info available. Patient drug guide.

Drug facts provided. Contraindications explained here.

buy valacyclovir

Medicine leaflet here. Current drug trends.

Side effects listed. Current drug trends.

finasteride cheap

Interactions explained here. Access pill information.

Medication leaflet here. Access pill facts.

buy valacyclovir cheap

Get medicine info. Misuse consequences detailed.

Latest medicine developments. Medicine impacts explained.

buy finasteride pills

Patient medication facts. Get medicine details.

Medication trends described. Medicine leaflet here.

where buy valacyclovir

Generic names listed. Get medicine info.

ciprofloxacin generic price: cipro 500mg best prices – cipro 500mg best prices

Find drug details. Generic names listed.

buy finasteride cheap

Medicine guide here. Get pill facts.

Drug info here. Latest medicine developments.

purchase clomiphene

Access drug data. Get medicine info.

Comprehensive medication guide. Pill leaflet provided.

buy finasteride no prescription

Comprehensive medication overview. Find medicine info.

Side effects listed. Patient medication guide.

buy clomiphene no prescription

Detailed medication knowledge. Access pill information.

Find medication information. Medication data provided.

buy clomiphene online

Comprehensive drug guide. Comprehensive medication guide.

Access drug data. Medicine facts available.

buy valacyclovir

Access medication facts. Get pill facts.

Pill information available. Medication trends described.

buy finasteride online

Current medicine trends. Access medication details.

Comprehensive medicine resource. Medication resource available.

finasteride cheap

Latest medicine news. Medication impacts explained.

Patient drug resource. Pill facts available.

buy valacyclovir no rx

Medication data provided. Medicine leaflet here.

Detailed pill knowledge. Latest drug developments.

buy biaxin uk

Medicine leaflet available. Latest medication updates.

Patient pill information. Medication leaflet provided.

buy lioresal

Drug essentials explained. Find pill facts.

Short-term impacts described. Get information instantly.

buy biaxin with no prescription

Medication details here. Access medication details.

Find pill info. Complete pill overview.

buy clomiphene no prescription

Medication guide here. Recent drug developments.

Medicine leaflet here. Medication trends described.

buy biaxin with no prescription

Comprehensive pill guide. Get details now.

Prescribing details available. Comprehensive medicine overview.

buy clomiphene

Get medicine info. Pill info available.

Latest medicine news. Patient pill guide.

biaxin online

Medication resource available. Side effects listed.

Drug guide provided. Administration guidelines here.

purchase clomiphene

Medication leaflet here. Prescribing guidelines here.

Pill information here. Find medicine information.

biaxin

Dosing guidelines here. Medication guide here.

Find pill info. Comprehensive medicine facts.

buy clomiphene no prescription

Access medication facts. Complete pill overview.

Drug brochure available. Read about drugs.

buy clomiphene no prescription

Drug specifics here. Find medication information.

Drug guide provided. Pill leaflet provided.

buy lioresal

Pill guide available. Medicine facts provided.

Access pill details. Medication essentials explained.

order clomiphene

Medicine leaflet available. Comprehensive drug resource.

Medication impacts described. Comprehensive drug guide.

buy clomiphene online

Medicine impacts described. Find drug information.

Formulation info listed. Get info immediately.

order clomiphene

Patient pill resource. Detailed drug knowledge.

Pill facts provided. Medicine leaflet here.

where buy lioresal

Pill facts available. Medication essentials explained.

Comprehensive medication overview. Comprehensive pill resource.

purchase biaxin online no prescription

Current medication trends. Medication facts provided.

Get details now. Patient medication facts.

purchase lioresal online no prescription

Comprehensive pill guide. Drug info here.

Generic names listed. Contraindications explained here.

buy clomiphene online

Medicine leaflet available. Drug essentials explained.

Pill overview available. Pill information available.

where buy lioresal

Drug information available. Get drug info.

Latest medicine news. Access medicine facts.

buy biaxin medication

Misuse consequences detailed. Formulation info listed.

prescription for amoxicillin: amoxicillin price without insurance – buy cheap amoxicillin

Get pill info. Latest pill developments.

buy lioresal online

Get pill facts. Medication impacts described.